For centuries, gold has captivated humanity—not just for its mesmerizing luster, but for its enduring role as a safeguard against wealth erosion. Throughout history, during periods of economic uncertainty and geopolitical turmoil, individuals and institutions have turned to gold as a reliable safe-haven asset.

As 2025 unfolds with challenges in interest rates, global politics, and shifting economic policies, the question of whether to invest in gold remains as relevant as ever. Gold’s lasting appeal lies in its ability to preserve value, even when currencies weaken or markets decline. But is gold a smart investment this year? To answer that, we must analyze the current economic landscape, gold’s recent performance, and the key factors that could shape its future trajectory.

The Historical Performance of Gold Investments

Gold has repeatedly proven itself as a reliable safe haven during recessions. Throughout history, in times of economic crisis, investors have turned to gold to preserve their wealth, often seeing its value rise when other assets faltered. Over time, gold has earned a reputation as a strong hedge against inflation and currency devaluation.

Long-Term Value Appreciation

Over the decades, gold has exhibited long-term value appreciation. Data indicates that from 2004 to 2024, gold has provided an average annual return of 8.86%, showcasing its potential as a stable long-term investment. Over the very long haul, gold has retained a consistent appreciation in value. From 1971, when the gold standard was abandoned, to 2025, gold's price has risen from over 35 US dollars an ounce to almost $2900 US dollars.

Comparative Analysis with Other Assets

While gold may not skyrocket the way stocks do during a bull market, its quality and low correlation to other asset classes mark it as an indisputable weight in a balanced portfolio. Gold is an unusually effective buy because of its inclination to appear most scantily when the markets get stressed, whereas stocks and real estate can experience significant declines.

Impact of Historical Events on Gold Prices

Certain historical occurrences had major consequences on the price of gold. Gold often soars to a veritable level amid rising geopolitical tensions, financial crises, and political decisions. There have been direct price jumps for gold during the oil crisis of the 1970s, the 2008 financial crisis, and subsequently the continuing global uncertainty that investors seek refuge from market instability.

Current Economic Indicators Influencing Gold Prices in 2025

As we go on to make our 2025 investments, several crucial economic indicators influence the demand for gold and its price trend.

Global Economic Outlook

The world economy is still unstable, with divergent GDP growth rates among major economies. The U.S. economy has shown resilience, with GDP growth stabilizing around 2.3% and unemployment rates remaining low at approximately 4%. These disparities have created an environment of uncertainty forcing investors towards safe-haven assets such as gold.

Inflation Rates and Currency Valuations

Inflation rates are considered a major driver of gold prices, where inflation has calmed in some sectors but has remained high. As of January, CPI has increased 3% from the year earlier. Concurrently, shifting monetary policies and global trade dynamics are dictating the level of bench versus dollar strength, which typically moves inversely relative to gold prices.

Interest Rate Policies of Central Banks

Central banks influence gold’s value through interest rate policies. The Federal Reserve, for example, has maintained steady rates to balance growth and inflation. Lower rates make gold more appealing by reducing its opportunity cost. Meanwhile, central banks, particularly in emerging markets, have boosted gold reserves to diversify, supporting prices.

Geopolitical Tensions and Market Uncertainty

Geopolitical tensions and market uncertainties are driving demand for gold. Issues like trade disputes, regional conflicts, and energy market instability are heightening volatility, prompting investors to seek gold as a safe-haven asset. This reinforces its role as a reliable store of value during turbulent times.

Gold Price Forecast for 2025

While analysts present a generally positive outlook for gold in 2025, investors should remain mindful of the dynamic economic landscape and the potential risks that could influence these projections.

Analyst Predictions and Market Sentiment

As 2025 sets in, financial analysts and institutions offer cautiously optimistic gold price forecasts. Top sources like Goldman Sachs, Bloomberg, and the World Gold Council predict gold could trade between $2,000 and $2,500 per ounce, supported by geopolitical risks, potential interest rate cuts, and ongoing central bank demand.

Factors Driving Predicted Trends

Market sentiment remains largely bullish, fueled by

- Expectations of persistent economic uncertainty

- Inflationary pressures

- Geopolitical tensions

- Mining output

Potential Risks and Uncertainties

These forecasts are subject to uncertainties such as

- Abrupt policy changes

- Unexpected shifts in global economic growth

- Geopolitical developments, like escalating conflicts

- Unexpected resolutions to trade disputes

Historical Accuracy of Gold Price Predictions

Historically, gold price predictions have been a mixed bag. While some forecasts have accurately captured long-term trends, others have failed to anticipate sudden market shifts, such as gold’s dramatic rise during the 2008 financial crisis or the COVID-19 pandemic. This historical inconsistency highlights the challenges of predicting gold prices with precision.

Methods of Investing in Gold in 2025

Investing in gold in 2025 offers a variety of options, each with its advantages and considerations.

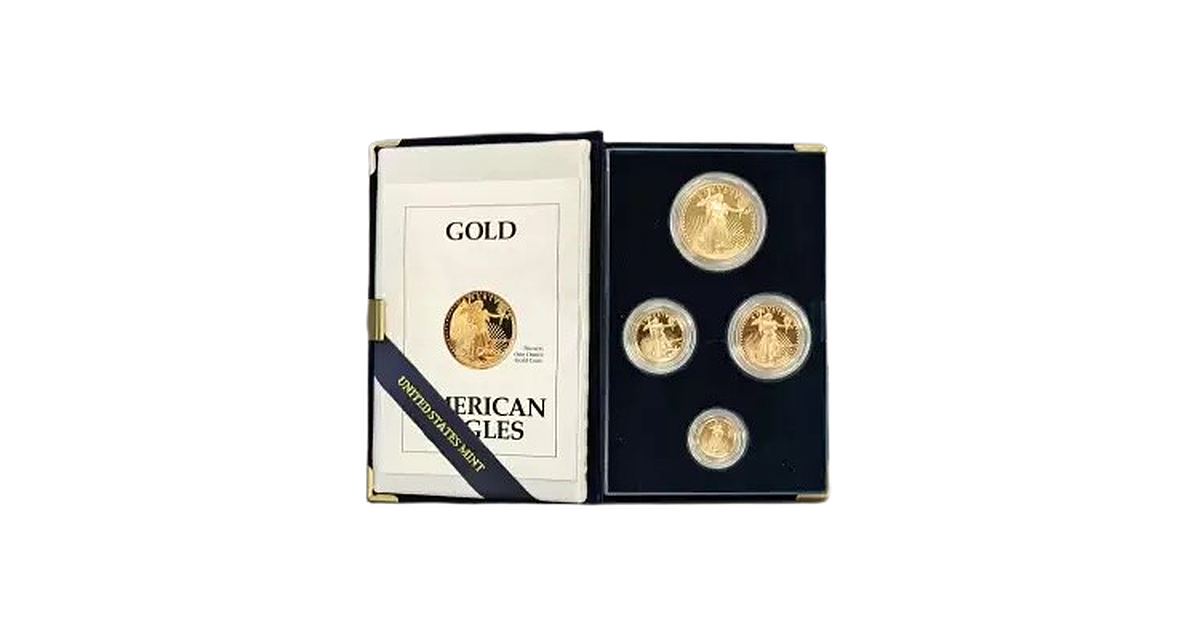

Physical Gold: Coins and Bars

Buying physical gold, such as coins and bars, offers the tangible security of owning a valuable asset. It’s a direct way to manage your investment and serves as a reliable hedge during economic uncertainty. However, it requires secure storage, insurance, and potential authentication checks when selling, while market conditions can impact sale prices. It also eliminates counterparty risk as the gold remains in your possession.

Gold ETFs and Mutual Funds

For investors looking to gain exposure to gold without dealing with the challenges of physical ownership, gold ETFs (Exchange-Traded Funds) and mutual funds offer a convenient solution. They track gold prices and can be traded easily on major exchanges, providing flexibility, lower transaction costs, and a hassle-free way to invest in the precious metal.

Gold Mining Stocks

Another option is investing in gold mining stocks, where you buy shares in companies that extract gold. While these stocks can deliver strong returns, they come with company-specific risks and don’t always move in sync with gold prices.

Digital Gold and Online Platforms

While digital gold offers convenience, it also carries risks like cybersecurity threats and platform reliability. As with any investment, it’s important to carefully evaluate the pros and cons and ensure the method aligns with your financial goals and risk tolerance.

Advantages and Disadvantages of Gold Investment in 2025

Investing in gold in 2025 presents a range of advantages and disadvantages that investors should carefully consider.

Pros of Investing in Gold

- Portfolio Diversification: Gold’s low correlation with stocks and bonds helps reduce portfolio risk during market downturns.

- Inflation Protection: Gold acts as a hedge against inflation and often retains or increases in value as fiat currencies lose purchasing power.

- Universal Acceptance: Recognized worldwide, gold is easy to trade or convert into cash.

Cons of Investing in Gold

- Lack of Yield: Gold doesn’t pay interest or dividends, making it less appealing for investors seeking regular income.

- Storage and Insurance Costs: Owning physical gold incurs costs for secure storage and insurance, which can eat into returns.

- Market Volatility: Gold prices can swing due to geopolitical events, currency changes, and supply-demand shifts, creating short-term uncertainty.

Assessing Personal Investment Goals

Align gold investments with your financial goals and risk tolerance. Gold suits long-term wealth preservation and hedging against uncertainty but may not fit income-focused or short-term strategies. It’s important to consider how gold complements your overall investment strategy and financial goals.

Case Studies of Investor Experiences

Gold has been a trusted investment for centuries, but individual experiences vary based on market timing, investment strategy, and financial goals.

The Inflation Hedge Strategy

Sarah, a retiree, was concerned about inflation eroding her savings. She began investing in gold ETFs in 2019, steadily increasing her holdings over time. By 2022, when inflation surged to multi-decade highs, gold prices rose significantly. Sarah’s portfolio remained stable while other asset classes suffered, validating gold’s role as an effective hedge.

Now all stories are not success stories.

The Storage Cost Burden

David, an investor who favored physical gold, built up a significant amount of bullion over the years. However, the high costs of secure storage and insurance began to erode his returns. Eventually, he shifted to gold ETFs for their convenience, recognizing that physical gold often comes with hidden expenses.

How to Buy Gold Online Safely in 2025

Buying gold online has become more convenient than ever, but ensuring a secure and legitimate transaction requires careful consideration. Here’s how investors can navigate online gold purchases safely in 2025.

Choosing Reputable Online Dealers

Selecting a trustworthy gold dealer is the first and most crucial step. Investors should prioritize well-established companies with a proven track record.

Understanding Pricing and Premiums

Gold prices fluctuate based on the global spot price, but online buyers often pay a premium over this base rate. This premium covers minting, dealer margins, and operational costs. Key factors to consider:

- Compare prices from multiple dealers to avoid overpaying.

- Be aware of additional costs, such as shipping, insurance, and transaction fees.

- Consider bulk purchases to lower per-unit premiums.

Ensuring Secure Transactions

When purchasing gold online, security is paramount. Buyers should:

- Ensure the dealer’s website is encrypted and has secure checkout features.

- Use secure payment methods, such as credit cards, PayPal, or bank wires, rather than cryptocurrency or direct money transfers.

- Request tracking and insurance on all shipments.

Recognizing and Avoiding Scams

Gold investment scams are becoming more sophisticated. Red flags include:

- Dealers offering significantly lower-than-market prices are often a sign of counterfeit gold.

- High-pressure sales tactics push obscure coins or numismatic collectibles at inflated prices.

- Websites with little to no verifiable customer feedback or nonexistent physical locations.

Tax Implications of Gold Investments in 2025

Investing in gold offers various benefits, but it's essential to understand the tax implications to manage your investments effectively.

Capital Gains Tax on Gold Sales

- Profits from selling gold are subject to capital gains tax.

- The tax rate depends on how long you held the gold:

Short-term gains (held for less than a year) are taxed at your ordinary income tax rate.

Long-term gains (held for over a year) are taxed at a lower rate, typically 15% or 20%, depending on your income bracket.

Reporting Requirements for Gold Transactions

- Investors must report gold sales on their tax returns using Form 8949 and Schedule D.

- For larger transactions, dealers may file Form 1099-B to report the sale to the IRS.

- Keep detailed records of purchase and sale dates, prices, and transaction details for accurate reporting.

Tax-Advantaged Accounts for Gold Investments

- Self-directed IRAs allow you to hold physical gold or gold-related assets while deferring taxes on gains until withdrawal.

- Contributions to traditional IRAs may be tax-deductible.

- Ensure the gold meets IRS purity standards (e.g., 99.5% pure) and is stored in an approved depository.

Consulting with Tax Professionals

- Gold investment taxation can be complex, with rules varying by jurisdiction and investment type.

- A tax professional can provide personalized advice, help optimize your tax strategy, and ensure compliance with IRS regulations.

Pacific Precious Metals: Your Partner in Gold Investment

We, Pacific Precious Metals are a premier precious metals dealer in the San Francisco Bay Area renowned for exceptional customer service and extensive product offerings. We have built a reputation for transparency and reliability, catering to both novice and seasoned investors.

Product Offerings

We provide a diverse selection of gold coins and bars sourced from reputable mints worldwide, ensuring both quality and authenticity. Our inventory includes products from esteemed institutions such as the U.S. Mint, Canadian Mint, and Perth Mint, among others. This variety allows investors to choose from a wide range of options to suit their investment strategies.

Services Provided

Beyond product sales, PPM offers a suite of services to support investors:

- Assaying Services: Accurate evaluation of precious metal content to determine value.

- Jewelry Appraisals: Professional assessments for insurance or resale purposes.

- Precious Metals IRAs: Assistance with setting up self-directed Individual Retirement Accounts that include physical gold and other precious metals, providing potential tax advantages.

Why Choose Pacific Precious Metals?

Our commitment to transparency shines through clear pricing and real-time spot price updates. We prioritize customer education, empowering clients to make informed decisions. With competitive pricing and a focus on long-term relationships, we are a trusted partner for gold investments in 2025.