2022 was considered a bad year for gold, in a way. There was a bit of growth, but the increase was sub-par compared to the expectations of experts and investors.

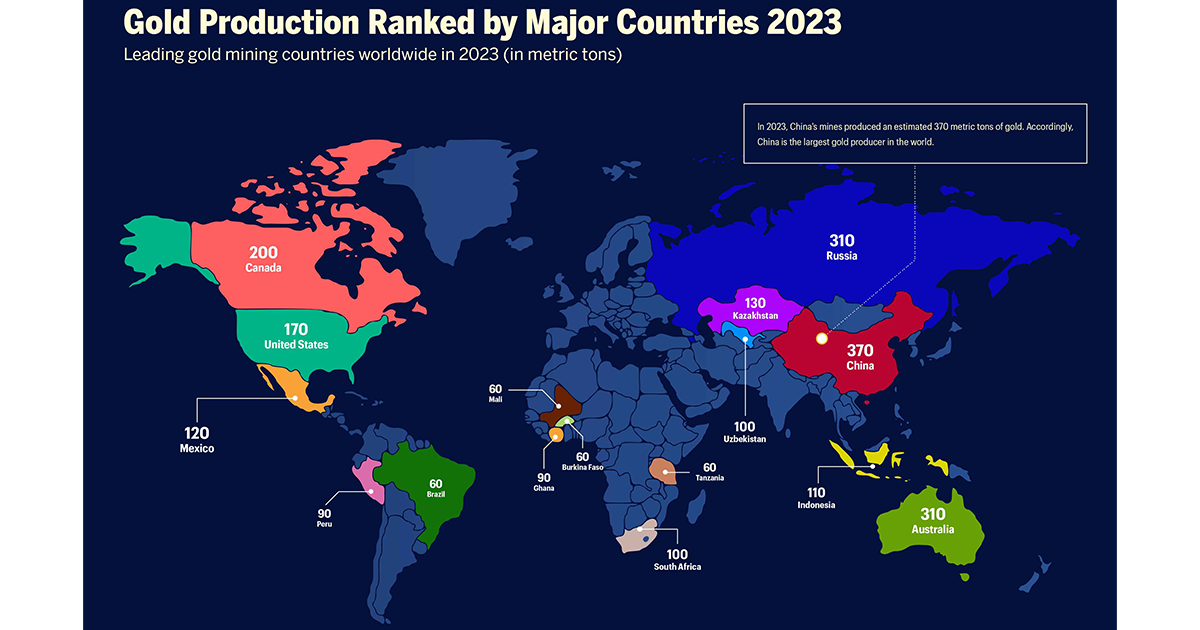

Things are looking up in 2023, but we must be prepared for some poor predictions. Economic uncertainty may affect the price of gold this year as it did in the previous one. The demand in China - the largest gold market in the world, was a big factor.

The Federal Reserve is still raising interest rates albeit at a slower pace, enabling gold to grow in price. Short-term speculations for gold are always exciting, but we must focus on the big picture.

How will gold perform in 2023, and what price trends can we expect?

Let's find out.

Why Invest in Gold?

Every currency is worth as much as the world decides, but gold is a limited asset - and it cannot be reproduced as paper money can. That being said, paper money can lose value, but gold doesn't lose value in the same way.

Gold prices can be affected short-term and experience losses, but gold is considered a hedge against inflation in the long term. When inflation drives the prices of everything up, gold prices rise faster than that.

So, if you preserve a portion of your wealth in gold rather than stocks, your money invested in gold will still be able to buy everything it could ten years ago.

Also, gold is protection during uncertain, trying times such as war. You can get the same price for your gold bullion anywhere in the world, but if you have a currency that currently experiences a huge loss in value, you might find yourself in trouble. For US investors, the reserve currency status of the USD protects from some of that, but we are seeing a general move away from the dollar in various places in the world. As the Federal Reserve continues to enact poor monetary policies, that trend is likely to continue.

Having some of your investment money set aside for more conservative investments, such as gold. Gold can support you if your stocks are performing poorly, but you should invest only a portion of your money in gold.

We advise keeping about 10% of your portfolio in gold while diversifying the rest into higher or middle-risk stocks and bonds. Consulting with your financial advisor on the blend of stocks, bonds, real estate, etc. is something you should do. But don't let your financial advisor convince you that gold is something you should not own.

Price Performance of Gold in 2022

Before we dive into the forecast for 2023, let's see the average prices for gold in 2022. Knowing past performance will give us better insight into this tangible investment.

In January, the gold market opened trading at $1,811.40 per ounce. The prices steadily grew for the next two months until the Russian invasion of Ukraine, when the prices hit the price of $1,936.30 per ounce.

The next day, the 25th of February, the prices fell to $1,884.80, but after that, the price of gold returned to steady growth. At the beginning of March, the price of gold was $2,050, but thanks to the Federal Reserve's monetary policies fighting rising inflation, gold fell under $2,000 per ounce.

Gold suffered from monetary policy tightening and rising inflation in spring 2022, making the prices drop to $1,817 in June. The second quarter saw a dramatic weakening of gold prices due to the aggressively rising interest rates of central banks all over the world, which used to control the rising inflation.

The gold experienced an all-time high in August, hitting the price of $2,075. The third quarter didn't look so good, as the gold bars and coins remained under $1,800 per ounce, and it saw a drop of about 8% in value. In fact, gold got down to just above $1600 in the fall.

The US dollar grew stronger, and the interest rate hike made many investors sell gold and go for other commodities on the markets. Luckily, by the end of 2022, gold prices had grown over 17%.

The current price is well over $1,900, allowing gold to return to the prices we haven't seen since April last year.

Forecasts for 2023

Looking at gold price charts from the last quarter of 2022, we can see that the price of gold bullion has started growing. Just like always, when the US dollar weakens, gold prices grow.

As always, we can expect that there will be some ups and downs during the entire year, but the predictions are great so far. Don't let poor performance in one quarter fool you; gold generally performs better long-term.

Commodities, including gold bullion, have extreme volatility in short-term periods. Investors rely on the fact that the US dollar will continue to weaken, along with some factors, but everything signals a good year for gold.

However, we cannot fully rely on that, as the Federal Reserve will continue to raise the interest rates in 2023, meaning that the gold price chart will probably be high, but we could experience some lows, too. The good thing is the rates aren't spiking up - they are slowing down, and we can work that to our advantage.

If the US dollar stays strong or stable in value, gold prices are unlikely to soar. On another note, the world is expecting an increase in demand for gold in China as the COVID restrictions are finally loosening up and central banks from Russia, India and other countries continue to add to their reserves.

The Shanghai gold exchange experienced some negative effects, as well as the Chinese economy, as soon as they changed the COVID policy, but we still predict that things are looking up for gold.

So, if you still need to invest in some gold coins, the right time would be now. With gold prices growing, buying gold might not be cheaper anytime soon. Meaning - buying gold today could be a fantastic way to make a profit, even short-term!

Price of Gold Forecast for the Next 5 Years

If you are looking to purchase gold bullion, you must be interested in how the gold price per ounce will perform in the upcoming years. The future results are what counts, and it's time to see if it's a good idea to buy gold now.

Looking at historical gold prices, the gold price chart shows steady growth throughout the decades. However, with the Russian invasion, everything changed, and now, the global market is recovering and some experts expect gold to suffer in value.

That doesn't have to be the case, as the historical data shows gold prices growing. Gold will rise as expected during this recession, along with weaker earnings and currencies.

A weakened dollar makes gold a more popular standard of trading as inflation recedes. With geopolitical issues in the world, this metal hedges against risk, allowing people to have money still, even if their chosen currency is worth nothing.

Also, the Chinese economy is recovering, which will positively affect the global demand for gold, further driving up the gold's price. Gold is widely popular in China, and its economy can certainly make an impact on the demand and price of gold.

Looking at trading gold short-term, we can see that the price changed a couple of times dramatically throughout one year. On the other hand, gold bullion is considered a safe investment, as it experiences stable growth.

In February 2012, gold traded for $1,725, and in January this year, it traded for $1,870. While gold certainly experienced a lot of downs in the past decade, the value of gold didn't change that much if you take into account the effect of inflation.

Gold is a traditional investment and has the upper hand compared to other currencies. When the US dollar weakens, it's time to turn to gold, as the prices usually rise during those periods.

Every chart has shown the correlation, and you should use that to your advantage in the trying markets in 2023. We expect fantastic performance in the next five years, making this the a great time to purchase gold bullion!

Final Thoughts

Investing in gold gives you direct access to the world's first way to preserve value. Every good portfolio must have a conservative investment, and gold is one of the safest ways to preserve wealth while investing a good portion into riskier investments that offer a better profit.

If you need to offset a risky investment, such as stocks, it's time to buy gold. During 2022, gold certainly experienced ups and downs, but at the end of the year, gold prices were growing steadily, and you should take advantage of that.

We advise you to purchase gold bullion or gold coins rather than jewelry. When buying gold jewelry, you will be required to pay a significant premium, making your profits much lower. Gold jewelry also isn't that easy to sell, and it is important to keep that in mind.

Lastly, if you want to invest some of your money and buy gold or another precious metal, try Pacific Precious Metals! We offer a competitive pricing and both fully insured shipping or pick up in person!